AT&T History

AT&T is a US-based telecommunications company. It is listed on the American stock market as among the Standard & Poor’s 500 firms. According to the S&P 500, it is ranked 23rd globally using its revenues, profits, assets and market value. In the global telecommunications industry, it is ranked 18th with approximately 126.4 million clients as of 2015. Initially, AT&T was founded in 1983 as Southern Bell Communications Inc. being among the regional holding companies created to hold AT&T Corp.’s local telephone communication companies. In 1984, SBC Communications Inc. broke off from AT&T Corp. through a court-ordered antitrust ruling. It became an independent telecommunications service provider before merging with one of the company’s branches in 2005. The company’s name changed from SBC Communications Inc. to AT&T Inc due to the merger (Salamone 50).

In addition, it became the best provider in communications around the globe. SBC Communications Inc. was a monopoly in the industry until 1982 when other telecommunications firms including MCI and Sprint emerged. AT&T’s headquarters are in Dallas, Texas and has a total workforce of 248,000 employees. The company’s mission is ”to be the world’s best at bringing individuals together creating a connection between them and availability of the services and information they want and need anytime, anywhere (Salamone 52).” It uses the AT&T brand name to market all the telecommunications services and products. Research indicates that AT&T Inc. generates annual revenues of $130 billion. The company attributes its success to a set of grand strategies and long-term objectives that have helped to achieve sustainable, competitive advantage and enhance its strategic position over local competitors.

The company’s operations are segmented into wireless and landlines where they sell their products and services. AT&T Inc. provides products and services ranging from wireless communications, local and long-distance phone calls, Internet, video, telecommunications gadgets, managed networking, and wholesale services. The wireless segment deals with nationwide wireless voice and data communications services while the landline segment involves retail and wholesale communication services both regional and globally. An overview of the products offered by AT&T Inc. evaluated according to their strengths and weaknesses to help determine future growth.

Wireless

This product is growing steadily in the market because of the high demand for speed by consumers. Unfortunately, AT&T does not offer varying wireless broadband capabilities, which exposes them to competition by other telecommunications companies. However, the company has initiated some grand strategies concerned with combining communications services through landline and mobile broadband on an international basis (Schwartz 33). These initiatives will ensure that they keep satisfying their clients’ needs and wants, and continue to see increases in revenue in the coming years.

Dialup Access

Research shows that most people use dialup access to connect and transfer data. The performance of the dialup modems is limited; therefore, AT&T developed WorldNet ISP services that capture a broad area of the domestic Internet market. Consumers prefer this service because it is reliable and less expensive. In their report, AT&T stated that by 2015, close to 50% of online households would be using broadband.

Digital Subscriber

AT&T Inc. benefits from DSL in providing telephone networks although in the future the cable network will overtake DSL in its total user provider utility. The company uses DSL service primarily for small businesses and corporate customers. Plans are in place to expand their markets from 17 to 100 by 2020 and include cable networks in those networks. The added markets will increase the revenues and stock for the company significantly.

Long Distance

AT&T Inc. is the number one company providing long-distance communications in the US. In North America, it is the largest, dominant network providing long-distance network services and the biggest digital wireless network. The broadband business has been facilitated by the strength and knowledge of the long-distance network. The company’s core competencies in this service include the provision of quality services to customers, offering reliable pricing, and the latest technology in mobile service across continents.

Cable Access

Using AT&T Labs, the company is concentrating on the use of telephone services and systems in favor of cable technology. The cable access is used to market other services, reaching a large population in a short period. However, a downside to this product is the degradation in performance due to the crowding on one cable distribution system by many users. AT&T is addressing this issue by developing strategies to mitigate the limitations, for example, LightWire. The more subscribers the company acquires, the higher the revenue in the near future.

The company’s objectives are to increase the share of access lines and broadband and help small enterprises to improve their operations by providing simple and effective solutions. AT&T Inc. has been developing new technologies to satisfy the changing demands of their customers. The company provides its communications services to over 80 million subscribers including customers, enterprises, and the government. Two years ago, they introduced a new wireless product named Aio that offers non-contractual purchase of services in advance for the users. Ultimately, AT&T Inc. is the prospect of the telecommunications industry.

Market Environment

The market environment has been favorable for the growth of the company. The company has been leveraging its current capabilities and opportunities and finding new applications for its existing products. It is using new development techniques to introduce new products in the market and change their existing products to satisfy the needs and wants of their customers. AT&T Inc. announced that later in the year,2015, they would offer a new product known as Remote Office Service (ROSE). The new product will use the AT&T network to transfer calls between the telecommuting work colleagues. In the two years, the company aims to offer its clients IP-based voice calls through its cable network. It will give the customers an alternative in the local market of telephony. The company faces the risk of implementation of regulations in the cable market to allow competitiveness in the use of cable lines. Competitors will use this opportunity to convince AT&T customers to switch by using their cable system. However, to prevent this from happening, regulations governing the communications industry should be implemented. AT&T Inc. will benefit from this because it will allow for the regulation of prices and thus keep the competition at bay.

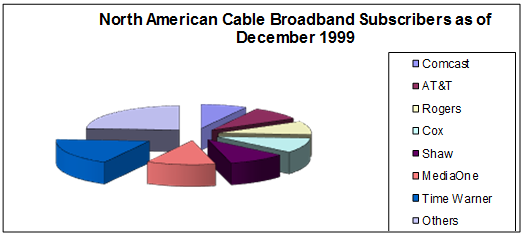

The company utilizes the business strategy outlined in the mission statement to improve its position in the Internet market, especially the consumer market. The company’s market share in the cable industry is high. In a research conducted in 1999 before AT&T acquired MediaOne, the company held a 9% market share with Time Warner leading at 18%. The market share increased to 21% after the acquisition making AT&T Inc the leading cable operator in the US. In addition, the company has collaborated with Comcast in various initiatives. All these initiatives are aimed at broadening the market for the products and services.

Comcast- 8%

AT&T- 9%

Rogers- 9%

Cox- 10%

Shaw- 10%

Time Warner- 18%

Others- 24%

Total- 100%

Due to the competition in the industry, AT&T has formed a broadband and Internet division to keep up with the demands of the market in this sector. The end consumer market faces a lot of competition from companies in the Internet provider industry. Therefore AT&T has ensured that its products, services, and capabilities complement their power to meet the market demand. Entry into the industry by more competitors will affect the company’s sales in the market negatively. AT&T was a monopoly before 1982, but research shows that the market in the cable sector will have more major players in the future. It will pose a risk to the market position of the AT&T Company. The customer base is expected to increase in the future because AT&T is making efforts to achieve a market share of the local market customer group.

AT&T has outlined in its grand strategy: the need to broaden its market areas to attract new customers through market development. The new market areas will be differentiated according to the geographical region or demographics. Improving on the existing products is underway to cater to all customers and satisfy the ever-changing demands. All of the company’s products, cable access, and wireless, will be upgraded to incorporate new technologies. Product development involves incurring perils and higher costs in implementation to develop new products for the current markets and improving or modifying existing products. AT&T has a wide market environment and offers services and products to a wide customer base regardless of the budget.

Competitive Strengths and Weakness

AT&T’s internal environment comprises most of its competitive strengths and weaknesses. The company’s competitors include Verizon, Sprint Nextel, and T-Mobile. Recent entrants into the market have been using lower prices to attract customers and other practices that regulatory agencies lack control over thus posing a challenge to the company. The low prices attract AT&T clients and thus, its products and services lack market. The company covers major areas and serves a large number of people, which is one of its strengths. It has dominated the wireless broadband technology and has created collaborations in wireless communication. The company has the advantage of building on a 115-year reputation as a founder of the telecommunications industry. It has continued to expand its locations where people can access its broadband Internet service (Karjaluoto, Jayawardhena, LeppaNiemi, and Pihlstrom 640). Offering data plans that provide the largest, most convenient services to the customers also gives the company a competitive advantage. The tighter profit margins characterize competitive weaknesses. They adversely affect the company’s profits, as people prefer lower costs regardless of the quality. It is true that people prefer quality but also want affordable prices. I do not contest that people are willing to pay more for better quality but there is a limit to how much more, the law of demand. The lack of flexibility limits the company’s options to adapt to an ever-changing wireless segment. Unlike the small competitors, AT&T’s structure is vast and complex making it difficult to bring new products to the market faster with low development expenses. The company has to be mindful of the large customer base and the FCC regulations that dictate its powers to gain market share and popularity. AT&T relies on its cable and dial-up technologies for internet access. It will face competition from regional Bell companies that offer broadband services like DSL. Most customers prefer DSL because it guarantees bandwidth and security. The company is working towards securing the cable networks to stay competitive and maintain the market share.

In an article by S&P 500, AT&T faces competition from Verizon in the telecom services sector because it offers higher current yield and a lower valuation but its future earnings and dividend growth are lower compared to Verizon. Verizon offers low current yield and a sound valuation and in turn, expects high future earnings and dividend growth. Its strengths are centered on the broad scope in the wireless and wired networks while the weaknesses it faces are declining wireline voice business. The evolution of the world into a technological universe allows AT&T to adopt the new technologies and incorporate them into their products. Recently, the company has expanded its AT&T-U-verse high-speed broadband and video services. It has also modified its IP-based services to suit their customers’ needs. Despite the company’s size being a weakness, when combined with leverage, it allows the company to take advantage of the maturing telecommunications space through its data services, capacity, and increased spectrum.

Invite your friends and get bonus from each order they

have made!

In the next five years, for the company to increase its revenue, earnings and stock prices, it has to change its internal environment, which comprises of the strengths and weaknesses (Pearce and Robinson 265). In the marketing capacity, AT&T will offer new products and technology and develop new market trends. To counter the new entrants, the company will have to acquire other firms, maximize its corporate resources, and adopt capital budgeting measures. The partner relationship will ensure the development of unique products different from those of its competitors. Quality control is another area that requires monitoring to ensure customer satisfaction. AT&T should incorporate DSL in their products or modify to gain a competitive advantage over the companies that are using DSL. These strategies will enable the company to achieve its targets in the next five years.

A SWOT analysis indicated that AT&T’s strengths include its strong global brand, which has over 250,000 employees from all over the world. It has also strengthened its presence in the world through the acquisition of other global telecom companies. The broad market and branches in over 200 countries have made it popular, serving over 100 million customers making it the second-largest provider of mobile services in the United States. The company’s financial statement, balance sheet, poses a threat to its progress. It exposes the company to more leverage than competitors within the industry.

Financial Statements

The financial statements of the company will continue to reflect profits in the next five years with the proper financial planning and progressive management (Zimmerman 419). The company’s financial strongholds will continue to increase over the next five years allowing the company to acquire other firms, increase its corporate resources and fund more research projects to improve its service delivery. From past financial records, the company has been experiencing steady growth in profits this trend is expected to continue. Good, efficient and strategic management of the company over the next five years will ensure the progressive increase in the stock prices. Proper planning is paramount to countering future problems and providing direction for the company. In turn, this will translate into higher revenues and earnings. The tables below indicate the company’s income statement, cash flow, and balance for the years 2010 to 2014. The figures show that in the next five years with the current trend the company will indeed increase its revenue, earnings and stock price.

INCOME STATEMENT

| Income statement | 2010 $ | 2011 $ | 2012 $ | 2013 $ | 2014 $ |

| Revenue | 124,280 | 126,723 | 127,434 | 128,752 | 132,447 |

| Gross Profit | 72,017 | 69,349 | 72,219 | 77,288 | 71,836 |

| Operating Income | 19,573 | 9,218 | 12,997 | 30,k479 | 11,746 |

| Net Income | 19,864 | 3,944 | 7,264 | 18,249 | 6,224 |

| Diluted EPS | 3.35 | 0.66 | 1.25 | 3.39 | 1.19 |

CASH FLOW

| Cash Flow (mil) | 2012 $ | 2013 $ | 2014 $ |

| Cash at the beginning of the year | 3,185 | 4,868 | 3,339 |

| Net Operating Cash | 39,176 | 34,796 | 31,338 |

| Net Investing Cash | (19,680) | (23,124) | (18,337) |

| Net Financing Cash | (17,673) | (13,201) | (7,737) |

| Net Change in Cash | 1,823 | 1,529 | 5,264 |

| Cash at end of the year | 4,868 | 3,339 | 8,603 |

| Cash Expenditure | 9,728 | 21,228 | 21,433 |

BALANCE SHEET

| Assets (mil) | 2012 $ | 2013 $ | 2014 $ |

| Current Assets | |||

| Cash | 4,868 | 3,339 | 8,603 |

| Net Receivables | 12,657 | 12,918 | 14,527 |

| Inventories | – | – | – |

| Other Income Assets | 3,110 | 4,780 | 6,925 |

| Asset Summary | |||

| Total Current Assets | 22,706 | 23,196 | 32,028 |

| Net Fixed Assets | 109,767 | 110,968 | 112,898 |

| Other Noncurrent Assets | 6,713 | 8,278 | 10,998 |

| Total Assets | 272,315 | 277,787 | 292,829 |

| Liabilities | 2012 | 2013 | 2014 |

| Current Liabilities | |||

| Accounts Payable | 14,875 | 15,614 | 18,186 |

| Short Term Debt | 3,486 | 5,498 | 6,056 |

| Other Current Liabilities | 3,808 | 4,212 | 4,105 |

| Long Term Debt | 66,358 | 69,290 | 76,011 |

| Other Noncurrent Liabilities | 11,925 | 16,260 | 18,543 |

| Total Liabilities | 179,953 | 186,799 | 206,459 |

| Stakeholder’s Equity (mil) | 2012 | 2013 | 2014 |

| equity | |||

| Preferred Stock Equity | – | – | – |

| Common Stock Equity | 6,495 | 6,495 | 6,495 |

| Equity Summary | |||

| Total Equity | 92,362 | 90,988 | 86,370 |

| Shares Outstanding | 5,581.3901 | 5,226.3198 | 5,581.3901 |

AT&T has a low credit rating, which means that it stands a risk of default and a high risk of failure. The figures indicate that the company’s operating revenues increased from 2012 to 2013 and from 2013 to 2014. AT&T’s best financial year was from 2012 to 2013 but the following year was a decline in its operations as most of the specifics declines, operating income, continuing operations, and net income. Year after year, the company has seen its net income fall from $18.2B to $6.2B. It contributes to the increase in sales of SGA costs from 22.07% to 29.97%. the above data shows that in the next five years AT&T Inc. will increase its revenue, earnings and stock prices as forecasted in the previous years.

Management and Labor Relations

The company provides pension and post-retirement benefits for its employees. It further takes care of its employee’s well-being, ensures that they are motivated, they have integrity and that they work diligently towards achieving organizational goals. The company provides an environment where employees can grow and improve in both their personal and professional capacities. AT&T also provides training and workshops for its employees, which motivates them to carry out the duties that help achieve the company’s objectives. The employee’s salaries range from $15,000 to $260,000, and they increase as the year progresses. They are allowed to offer ideas and opinions on the management of the company. It fosters employee loyalty, a sense of belonging and encourages them to take the initiative in ensuring the company maximizes its profits through an increase in the rate of return as compared to the risks encountered (Pearce and Robinson 390). The employees’ motivation towards building the company has led to an increase in revenue. AT&T does not limit its employees from joining labor unions that deal with employee welfare.

Employee development is one of the areas covered by the company’s long-term strategies. It offers education and training to its staff members and financial reimbursement and support to employees desiring to expand their level of education. The aim of this strategy is for the company to develop and maintain a highly trained and highly skilled workforce. The goals of the company are achieved through the help of skilled personnel. The company recognizes its employees because it is their efforts that have helped AT&T remain competitive. AT&T has been named as the industry’s employer of choice, creating employment to many in a diversified manner that it reflects the customer base they serve. Statistics show that the company’s workforce includes 39% female and 39% of people of color in its 50-state. The company has started employee resource groups (ERGs) with open membership to all the staff members, which indicates the wide range of the employee base.

It also offers a high level of demanded salaries and employee benefits, market competitive health and welfare, pension and savings plan. These benefits are open to all organizational staff members, retired employees, and dependents. The company experiences low employee turnover because at AT&T the employees are provided with the chance to grow and utilize their skills. It has collaborated with several unions to ensure the safety, equal treatment and economic development of the employees. Some of the union partnerships it is involved with are Communications Workers of America and the International Brotherhood of Electrical Workers. Fifty-four percent of the employees at AT&T are represented at unions with the company offering full-time jobs compared to any other company in North America. As of 2005, 21,000 employees were in the wireless union and the number has increased to 41,000 in recent years. The company has founded a wireless union, the CWA Spotlights Wireless Service, which is the only wireless union in the country, with almost all AT&T employees being members.

Regulation and Litigation Issues

In the recent past, the company has had some litigation and fines imposed. The fines have led to a loss of revenue, a negative brand image and a drop in the stock prices (Zimmerman 430). If the company adheres to the set laws and regulations, it will not suffer any losses in revenue from the costs of litigation. The stock prices will also rise or remain at a steady price. AT&T offers its products and services using the Internet. The internet is a market that is highly regulated. In the next five years, changes in the regulations can affect the company positively or negatively. The company’s efforts in this area are dynamic such as lobbying staff.

The federal government is concerned with the company’s operations and monitors all the activities AT&T carries out. Recently, the federal government has enacted legislation in regard to open access to cable systems. The law affects the company’s operations negatively hence AT&T has developed ways to avoid federal intervention. The formation of strategic partnerships will deter the federal government from intervening in the company’s operations. These partnerships will be made with competitors seeking access to the AT&T cable networks. In a report by the company’s CEO, the potential competitors selected to become partners include AOL, MindSpring, or other national ISPs. Aside from preventing the federal government’s legislation, the partnerships will help the company take advantage of the market opportunity to increase their growth. They are to complement their own strengths in the form of equity investments, joint ventures or economic alliances.

Regulations are also imposed on profitability. AT&T’s main objective of carrying out business is to maximize profitability. It portrays fiscal responsibility to shareholders through the measurement of earnings. Currently, the analysis of revenue data is $1.19. The company’s future projection in the next five years is to achieve yearly income per share growth of 20%. The federal government has introduced regulations that affect how the company carries its operations. For example, the government recently introduced regulations on the opening of cable television networks to other competitors through the Internet access sector. These regulations limit the profitability of the company therefore, in order to maintain profitability AT&T has developed revenue-beneficial open access cable initiatives. The program will increase the company’s revenue in the next five years because no competitors will have access to their cable Internet market.

The government requires that the FCC provide communication services under specific frequencies in an assigned geographical region license all wireless communications. The regulations determine the rates and services to be used by companies, local, long-distance and network access services. These regulations allow equal pricing and rates of internet services between interstate and international states.

Domestic and Foreign Macro Issues

The company lacks the strategies to control the macro issues that may affect the market both domestically and globally. However, it can put in place strategies to mitigate the effects. It will reduce the loss of income to the company. AT&T has formed alliances and partnerships to improve the products and services it offers and reach a broader target market. It is also a way to venture into a new business. The company has been working with some of its competitors in the trade market areas to provide services. The recent purchase of TCI by the company and MediaOne has led it to become the largest cable provider in the area. It launched an effort to offer broadband Internet service and telephone services over a broad network of cables (Werbach 61). These alliances and partnerships strengthen the company and reduce the risk of losing its market share. In expanding its market, AT&T signed a legal contract with the leading developer of personal computer software systems and Microsoft applications to increase the deployment of broadband services. In a speech, the two agreed to release products and services for the use of the next-generation of Americans.

Common in both the domestic and foreign macro sectors is the issue of technological advancement. Technology is important to the business both on a local and international basis. On the domestic level, competitors are always seeking new technologies to help them improve their products and services. On an international level, it is important to forecast the future of technology for companies to be prepared for any change in environmental factors. The telecommunications industry is open to changes in technology and Internet access is a technology that can affect AT&T’s market place. A number of trends in both the domestic and foreign macro sectors are bound to affect the future of AT&T Company.

Cable Systems Industry Trends

AT&T uses the cable network that limits it to downstream service compared to the competitor’s network access products such as DSL. The company is working towards upgrading its network as well as ensuring Internet security. The issue of Internet security has been a catastrophe both in the domestic and international markets. AT&T is concerned with satisfying its customers, and providing Internet security to them is one of their objectives. It is for this purpose that the company is developing new strategies to assist its customers in securing their internet systems (Goldberg 10).

Dialup Services Industry Trends

Dialup services are popular because of the speed of the connection they provide. On a domestic level, the technology used by the dial-up services might not change in the next five years although on a foreign macro level and with the development of innovative technologies the outcome might be different. However, dial-up service might undergo changes in the next five years. The concept of access to the free Internet will affect the company negatively because AT&T’s WorldNet service does not match the software.

New Trends in the Foreign Arena

The use of the wireless service in AT&T has provided a competitive advantage over its competitors. The service has gone beyond regional use making its way to other countries in the world, for example in Japan. However, the company is disadvantaged because it does not own any satellites. It is not incorporated in the design, evaluation or implementation of wireless Internet access technology. In responding to the issue on DSL, the company is incorporating it to offer customers better and faster connections in comparison with dial-up services. DSL, as mentioned earlier, also offers relative prices that are competitive. These initiatives are aimed at broadening the company’s markets at both the domestic and international levels.

The company’s domestic and foreign macro issues involve penetration of the company into new markets. It also involves the development of new technology to help improve the products and services offered by the company. AT&T is striving to remain the leading telecommunications company in America and the entire world. The domestic and foreign macro issues affect these efforts, as the company is unable to address most of the foreign macro issues. Competitors comprise of the domestic issues as research shows that many companies will venture into the telecommunications industry in the next five years. The government has also enacted legislation that favors the entry of competitors in the industry, hindering the pricing strategies of AT&T.

Other Issues Pertinent to the Business

AT&T should have a strategy to predict all possible future occurrences in the market that may affect its financial position to increase its revenues, earnings and stock price over the next five years (Karjaluoto, Jayawardhena, LeppaNiemi, and Pihlstrom 639). The company should also carry out research and development projects to introduce products that will give them a competitive advantage over their competition. The external environment affects the operations of the company including its financial position in the next five years. AT&T.’s macro-environment includes competitive risks and advantages. They should keep abreast of technology and incorporate new technology in the design and production of new products and services. Competitors are using innovative technologies, which is a threat to AT&T because they possess labs that are using old technology. The company is disabling the use of older technology, such as microwave links that comprise of the external environment.

The best technique to be applied by AT&T in forecasting the revenues in the next five years is by knowing the future of the technologies by monitoring them. The team dedicated to the production of new products should do research on the environment to generate ideas that can be used by the end-users in their products and services. A series of processes need to be followed, identifying current innovations that can lead to technological change, analyze the consequences of the new technology; develop a technique that can measure the direction and speed of the innovation, and incorporate the data collected into management decisions. It is paramount to note that the company should review the developers of the hardware used for dialup, cable, wireless and DSL services. Keeping up with the current trends will ensure that the company is aware of the new technologies in the industry.

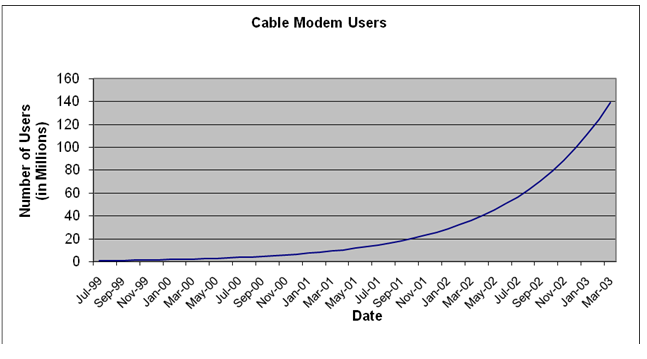

The future revenues can be forecasted by studying the past data in a graphical manner to predict the direction of the company. The graph below shows a prediction in the years 1999-2003. The graph shows the number of modem subscribers in the U.S and Canada and the figures was used to predict the future of modems. The strategy involves trend extrapolation and it can be used to forecast the revenues, earnings, and stock prices of the company in the next five years.

As predicted by the graph, in March 2003 the number of people using cable modems was 140 million. The same method can be used to determine the future of the company. AT&T has adopted the method in analyzing the market place for innovative technologic trends and predicting future demand for their products and services.

In addition to the pertinent issues, AT&T annual report states that their implemented strategy is to strengthen their position as the global leader in networking. Their main strength is the ability to develop and manage networks since they are the foundation of the business. The network is combined with computing, communications, and network products and systems. The company’s network use is increased through the improvement of the company’s network as well as the network of other service providers. In providing the best customer service and satisfying their needs and wants, the company provides integrated, end-to-end network solutions.

Recommendations

AT&T will improve its revenue, earnings, and stock price in the next five years by implementing realistic, measurable, achievable, specific and time-bound (SMART) goals. The company should classify its strategies as both grand and long-term for easier implementation and evaluation. The issues addressed in the grand strategy include concentrated growth, market development, product development, innovation, concentric diversification, and strategic partnership. In concentrated growth, the company will focus on a unique product and market combination. The application of this strategy is less risky and since AT&T’s products are based on communication, they can utilize these to exploit the expertise and gain a larger market share. It will also increase the current customers’ purchasing power of their products. Market development as a strategy to be applied in the market environment will involve identifying new market areas. Market development involves identifying new target markets for the current products as well as new products (Pierce and Robinson 260). The company should widen its business to other locations with demand for their products and develop new products to cater to the changing demands in customer needs and wants.

The third aspect of the AT&T grand strategy will involve product development. The strategy is risky and requires higher costs in implementing it. The company should develop new products and modify existing ones to maintain customer loyalty. The products will cater for all customer types regardless of the budget. As of now, AT&T does not have products for low-income customers. In the innovation field, the company will need to invest in innovative technologies. It is achieved through maximum utilization of facilities to increase the current abilities and skills of the present and future internet-access to ensure the company stays competitive. The technology developed should ensure that customers experience speed, credibility and security through the cable systems. Concentric diversification is acquiring businesses that are related in technological use, markets and products. Local and regional ISP’s enterprises will allow the company to combine cable services and increase its benefits of delivering technology and minding the future. Finally, in the grand strategy, another recommendation would be strategic partnership. The partnerships involve joining forces with competitors to reduce the risk of losing its market share. They will also allow the company to expand its markets and reduce government intervention.

The areas that need changing in the long-term strategies are profitability, competitive position, technological leadership, and employee development. Profitability involves the increase in the rate of returns as compared to the risks involved. AT&T should aim at maximizing its profits through the set objectives and goals. Profitability allows the company’s management to portray fiscal responsibility to its shareholders. In the next five years, the company should ensure that the annual earnings per share growth have increased from 15% to 20%. In addition, AT&T should outline its core competencies to create an advantage over its competitors to ensure it stays dominant in the market. This goal will be achieved through the formation of acquisitions of regional cable providers and an increase in the Internet access service through advertising. The company should also strive to acquire the DSL access that is preferred by most customers due to the low prices. Most of the competitors offer DSL, which attracts many clients even those that are loyal to AT&T. AT&T’s most revenue is from the wireless broadband market, and it should concentrate on improving the service to ensure the company capitalizes on the already existing market.

Struggling with your essay?

Ask professionals to help you!

Start Chat

Technology is always changing in the modern world. It is among one the sectors that have led to the success of AT&T. It should assign significant financial and human capital in the technology sector to ensure that the company stays dominant. AT&T should keep abreast of the latest technologies to incorporate them into the development of its products and distribution of its services (Hattleberg 45). A research team should be assigned to study the external market and analyze the current technologies that are meaningful to the company and help achieve the set objectives and goals. Finally, employee development in the company is an integral part of the long-term strategies. Employee compensation and motivation are important in ensuring that the company achieves its set objectives and goals. Diversification of the employees and equality in the workplace should be addressed to ensure the company improves its products increasing revenue. The strategies when followed will improve AT&T operations, maximize its profits and in the next five years, a significant change will be evident from the revenue, earnings and stock prices in the financial statements.

Conclusion

AT&T Inc. will improve its competitive power in the home user Internet market over the next five years with resulting in increased profits with the use of a good strategy and focus on the long-term objectives. The market will allow the company to remain dominant in the telecommunications industry maintaining all its customers. These will provide superior internet access to their loyal clients that use the services for home purposes. AT&T should have a strategy to predict all possible future occurrences in the market that may affect its financial position to increase its revenues, earnings and stock price over the next five years. The company should also carry out research and development projects to introduce products that will give them an advantage over their competition. The financial statements indicate that investors are attracted to AT&T due to the price of their shares. The stocks offer the company an admirable income source compared to other items in the balance sheet. The equity allows bargaining on earnings at the company’s price level. The company has the benefit of a strong brand name and a compound market share that allows it to remain dominant in the telecommunications industry.

AT&T has unexploited opportunities that can be used to its advantage. These are acquisitions and developed platform. The current acquisitions that the company has engaged in have helped expand its market base and increased its profitability. Recently, the company acquired Direct TV (DTV), a pay-for-television service that has enabled it to penetrate new markets through the use of media. DTV is popular in Latin America and this has provided market form the company. The result has been increased cash flow and cost savings for the next approximately five years. The acquisitions also provide the development of products that are serving lower-income customers. However, continued price wars pose a great threat to the company. A main competitor of AT&T, Verizon, offers reduced prices to their customers, and this reduces the market for AT&T products. Sprint, another telecommunications competitor, provides great deals to its customers, for example, reducing their wireless bills by half. These campaigns have an effect on the company’s market share and result in the loss of customers. Price wars affect the service providers negatively while the customers are on the winning end of any outcome.

In conclusion, it is essential to note that AT&T Inc. will continue to face competition from the major telecommunications players that will join the industry. However, with the clear strategy that the company has outlined it will maintain its market share and customer loyalty. The development of new products will increase its profitability hence, increasing its revenues, earnings, and stock prices in the next five years.